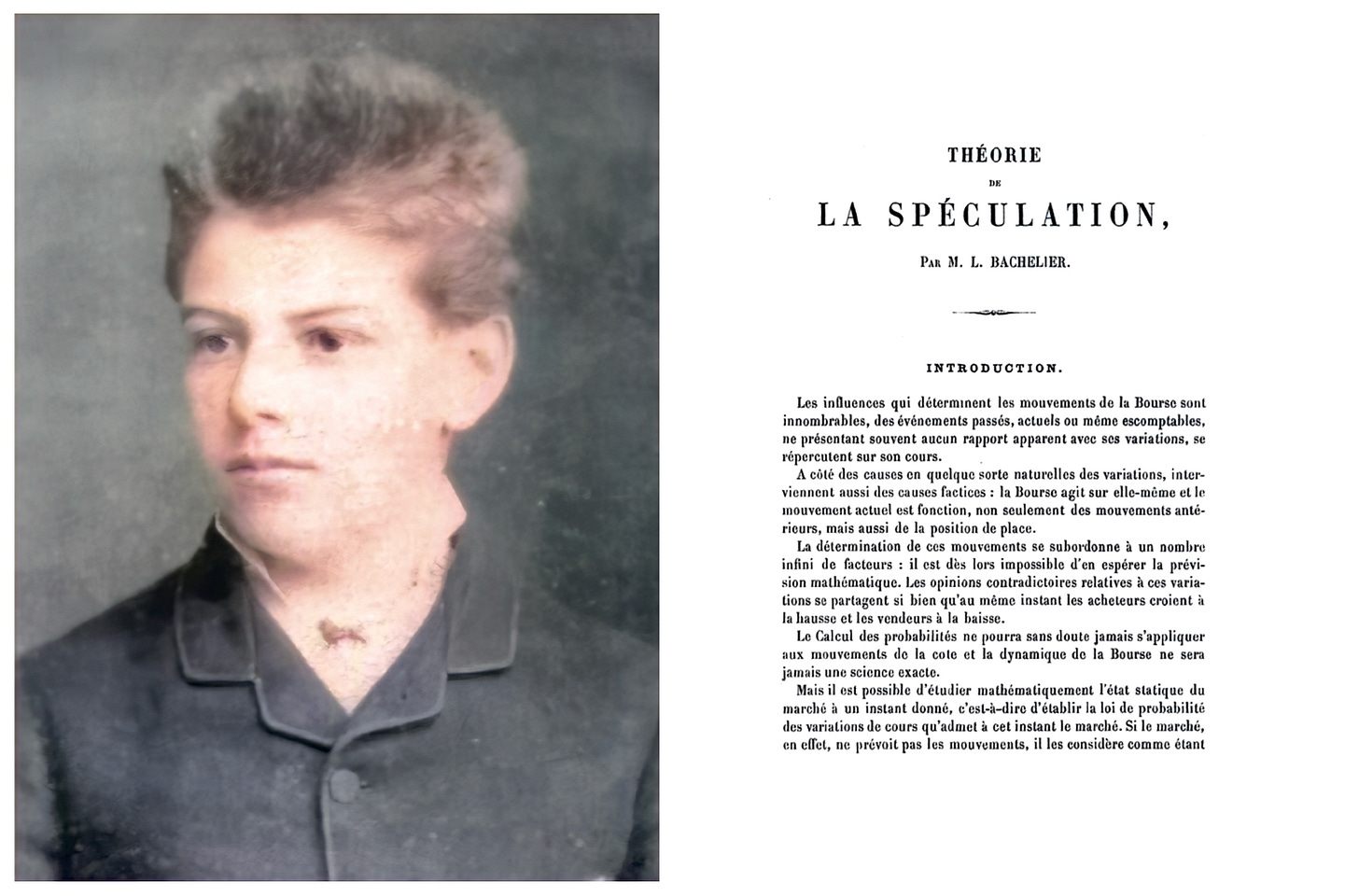

Louis Bachelier's Theory of Speculation (1900)

If asset prices in the short term show an identifiable pattern, won’t speculators find this pattern and exploit it, thereby eliminating it?

Are financial markets inherently unpredictable? Let’s suppose they aren’t. Let’s suppose there are patterns that may be discerned by humans or computers, and acted upon. What would that do to the prices of those assets? Let’s think it over. The simplest case of benefitting from a predictable pattern is probably buying an asset prior to a predicted movement upward in such a way at least in theory, one benefits from the expected increase in price.

However, if the person buying the asset is expecting its price to rise according to a prediction about the future movements of the market (based on historical information) the buyer is not including in his/her expectation what his/her own buying of the asset will do to the price in the future. Having bought the asset, the buyer increases demand in such a way that the price for the asset…